Estimated Guess

Wednesday, January 25, 2012

$27 per Minute

Monday, July 11, 2011

Never Pump Gas and Smoke

People tend to respond to rewards and punishment, whether economic or physical, as a method of changing behavior. As a society, we have decided to have both positive (subsidies) and negative effects (taxation & jail) of actions to help influence the decisions that, as a society, we have decided are more beneficial.

For example, we tax cigarettes anywhere from $0.17 per pack in Missouri to $4.351 per pack in New York, with the intent of reducing use in society. In 2002 the CDC released a report that stated when Health Care costs and lost productivity costs are factored in, each pack of cigarettes smoked costs taxpayers, on average, the $7.002. This means that even New York taxes of $4.35 still passes $2.65 to the tax payer in the form of income tax and Medicaid/Medicare taxes. If taxes were raised to fully encompass the total cost of each pack of cigarettes, this influence would likely deter some individuals from smoking. Instead, the U.S. tax payer, who chooses not to smoke, subsidizes the use of cigarettes by those who do.

Thankfully for us all, cigarettes, and the total cost to the tax payer for all of the smokers in America comes to only $157 Billion, or about 4.4% of the total US Budget. What about other products that Americans use in greater quantity than cigarettes, could we be hurting ourselves by not including the full cost of other products in their price?

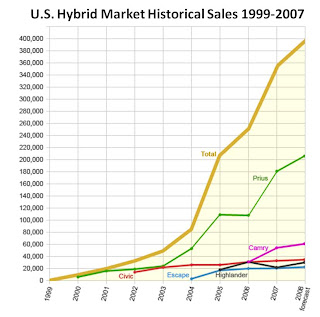

Gasoline prices have gone up in the past few years, causing outrage, spurring government action, changing the way people drive and the products that we choose to buy. Hybrid cars for example, have grown dramatically in the last few years3. We can all agree that the actual price of gas is not fully represented within the price to consumers when you factor in tax subsidies, program subsidies, protection subsidies (such as military action, funding to stabilize OPEC countries, etc), and environmental health and social costs. While some of these added costs are difficult to quantify, some are fairly simple and can be accurately accounted in to the price of a gallon of gas.

The best estimates of the tax subsidies put the total annual tax breaks that support gas production at $9.1 to $17.8 billion4. While yes, these are tax breaks, and one could argue they are not direct costs, the U.S. must still borrow and tax income at a greater rate because of these tax benefits. Program subsidies, which include cleanup and liability costs among other things cost tax payers between $38 and $114.6 billion4 each year (To be fair, 36 billion to 112 billion of this is used for roads and infrastructure and would continue to be spent even if everyone was driving an electric car).

Protection services total $55 to $96.3 billion4 per year, and social services and health costs are estimated to total $231.7 to $942.9 billion4 per year. I have also not included costs from travel delays and road congestion as these would remain, regardless of the transportation method.

So once we factor in all associated costs we can conclude that the average price of gas, if all costs are factored in, would put the price point between $5.60 and $15.144 per gallon at the pump.

Currently average gas price in the UK is around $6.52 per gallon (1.08£ per liter) and Germany is around $8.52 per gallon; one could make an argument that the UK & Germany are recognizing the full cost of gasoline in its price.

It would be very interesting to see what would happen to the social demand for development of electric cars and alternative forms of energy if a gallon of gas suddenly were to rise to $8.00 per gallon and encompass the total cost of the product in the price. Likely people would respond to the influences of taxation and develop more sustainable solutions.

Sources:

1. (Orzechowski & Walker, Tax Burden on Tobacco, 2010; media reports)

2. http://www.nytimes.com/2002/04/12/us/cigarettes-cost-us-7-per-pack-sold-study-says.html

3. http://www.hybridcars.com/files/apr08-hybrid-market-dashboard-v4.pdf

Friday, July 8, 2011

Are We Partying Like it’s 1999

It seems every day a new internet based company is having an IPO, are we the next great advancement in business or are we partying like it’s 1999?

Could this be the rebranding of Pets.com, the poster-child of the dot-com bubble, or are we truly beginning to see the dawn of a new set of Internet based companies? Companies which have a customer base, provide a set of value-added products or services to their customers, and are generating revenues.

On May 20th 2011 the LinkedIn professional social network with over 100 million members, had its first IPO; shares were set at $45. For a company that had a Net Income of $15.4 million last year and Revenues of $243 million investors were excited when 10% of outstanding shares were quickly purchased and traded. By the end of the day the shares were trading at $94.25 per share, valuing the company at $8.9 Billion. This was the largest IPO since Google Inc’s debut in 2004.

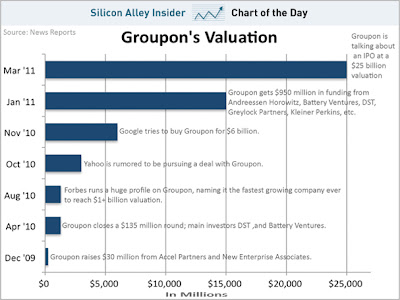

LinkedIn is not alone in valuations that seem disproportionate; Facebook was recently valued at $70 billion, up from 35 billion at the end of last year, a 100% gain in only a few months. Skype SARL was recently purchased by Microsoft Corp. in an 8.5 billion all-cash deal. Groupon is said to be discussing valuations of up to $25 billion, after denying Google Inc.’s offer to purchase Groupon for $6 billion in November of 2010. We’ve seen skyrocketing valuations like this before…things didn’t end well.

With the deployment of Google+ in recent days, what would Michael Porter think about these company valuations and industry profitability? Many of these internet based companies reside in industries with very few barriers to entry, high supplier power, high buyer power, several substitutes, and high competition. One wonders how valuations of businesses in these industries could rise so rapidly.Take Groupon for example:

While many of us use Groupon to save 50% or more, what does Groupon provide to a consumer that Google would not be able to provide more cost efficiently. With such low barriers to entry, and low switching costs, how challenging would it be for Google to start its own coupon program and quickly gain customers; Google Coupons perhaps? Google would be able to capitalize on synergies within the industry, relying on data processing, storage and (arguably) innovation. Moreover could a locally-focused “low cost Groupon Imitator,” or behemoth, such as Google, develop strategies which better fit their target audience, leaving Groupon straddling the line between low cost and differentiated.

This begs the question, is a company with (likely) few assets, located within such an undesirable industry worth the $25 billion valuation? Or could up-and-coming competition, able to capitalize on synergies, wreak havoc on these valuations?

Similarly Google+ may signal the end of the growth phase for Facebook, as consumers, fed up with constant privacy concerns, decide to send Facebook the way of MySpace (Someone call Justin Timberlake). Might we be witnessing the beginning of the end for two of the largest players on the internet?

Then again there are differences between this dot-com boom and the previous one. For one thing companies that go public now, and there are fewer of them, have a proven track record of generating revenues. Many of the companies that went public in the late 90’s had not generated income or revenue at the time of their IPO.

Only time will tell if the valuations of these internet based companies are accurate, or if they have progressed in to the trap of boom and bust we have seen in the past. Two things move the market, greed and fear, and after two and a half years of fearing the market, greed may be once again taking over.

Thursday, July 7, 2011

Dot-Coms & Dutch Tulips

Would you pay ten times your yearly salary for a plant that will most likely die in about a week? Does paying $300,000 for a tulip seem like too much? In this post we will briefly explore arguably the first recorded economic bubble.

First a little background: Tulip mania or tulipomania was a period in the Dutch golden age when tulips were trading at extraordinarily high levels and then suddenly collapsed. In 1637 some tulips were trading at up to 10x times the annual income of a skilled craftsman. After the tulip was introduced by the Ottoman Empire in the mid-16th century, it quickly became a status symbol and desired by all. Tulips, which grow from bulbs, can only be uprooted and moved from about June to September and actual purchases of tulips would occur during these months. During the rest of the year traders would sign contracts to purchase tulips at the end of the season, thus the Dutch effectively created the first futures contract as a product of the market for durable tulip bulbs.

Interestingly enough, the Dutch also developed the concept of “shorting” the tulip market, which, simply put, means if the value of the tulip goes down, the purchaser of the short makes more money, and likewise if the value goes up, the purchaser of the short loses money (a practice quickly banned by the government but legal today).

People were purchasing bulbs at higher and higher prices, intending to resell them for a profit; however this scheme could not last unless someone was ultimately willing to pay such a high price. When speculators could no longer find someone to buy at the inflated price, demand began to collapse and prices plummeted as the speculative bubble began to burst. Some found themselves holding a contract to purchase tulip bulbs at ten times their market value and others found themselves in possession of bulbs worth just a fraction of the price they had paid.

How could individuals and society as a whole become so enamored with tulips that they were willing to pay astronomical prices compared to the intrinsic value of the bulb itself? Could people have been so foolish back then?

While the exact cause of the rise, and dramatic fall of the tulip prices during the late 1630’s is contested, partly because of the lack of accurate bookkeeping during the time, one suggested cause is still seen today: Social mania, which leads to the boom and bust cycles we see in the stock market today, such as the dot-com bubble and the housing bubble.

The dot-com bubble from 1995-2001 ended on march 10th 2000 with a NASDAQ peeking at 5,132.52. (For reference, it is about 2,830 as of today) During this period, investors who were just beginning to understand the monetization capability of the internet, invested large amounts of money in companies which were producing large annual losses. It was dot-com theory at the time for an internet company to expand its customer base as rapidly as possible even if it produced large annual losses. “Get large or get lost” was the wisdom of the day. At the height of the dot-com bubble it was possible for a promising dot-com to make an IPO of its stock and raise a substantial amount of money even though it had never made a profit, or earned any revenue.

When the bubble burst, fortunes were lost. As the NASDAQ lost more value, more people sold, which caused further losses and further selling; a pattern that continued on for some time until the rational market determined a truly fair price to pay for shares of dot-coms.

While not all dot-coms went bankrupt, as some were purchased by other companies, and some remain today, many fell in to the same pattern we saw almost 400 years ago. E.Digital Corporation for example traded for $2.91 on December 31st 1999 and quickly rose to $24.50 on January 24th 2000 less than a month later. As the bubble burst it fell to between $0.07 and $0.16 per share losing about 99.4% of its value in a few weeks. Could we really have valued shares at over 150x their market value and fallen victim to the same boom and bust seen with tulips?

The idea that the boom and bust cycle is a thing of the past and won’t happen again is a false assumption. It’s nearly impossible to see the see the bubble while you’re in it, and even harder to time the market. There will be more bubbles and more fortunes lost, as the short term value of an asset is still driven by investors, who have emotions and are human. Be wary when buying tulips, or flipping a house, or starting a dot-com seems to be the “investment of the week,” you may find yourself holding a valueless tulip bulb you overpaid for, even if everyone promised that “This time it’s different.”