It seems every day a new internet based company is having an IPO, are we the next great advancement in business or are we partying like it’s 1999?

Could this be the rebranding of Pets.com, the poster-child of the dot-com bubble, or are we truly beginning to see the dawn of a new set of Internet based companies? Companies which have a customer base, provide a set of value-added products or services to their customers, and are generating revenues.

On May 20th 2011 the LinkedIn professional social network with over 100 million members, had its first IPO; shares were set at $45. For a company that had a Net Income of $15.4 million last year and Revenues of $243 million investors were excited when 10% of outstanding shares were quickly purchased and traded. By the end of the day the shares were trading at $94.25 per share, valuing the company at $8.9 Billion. This was the largest IPO since Google Inc’s debut in 2004.

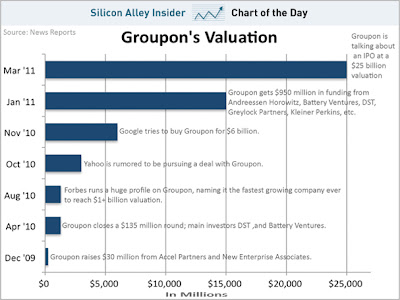

LinkedIn is not alone in valuations that seem disproportionate; Facebook was recently valued at $70 billion, up from 35 billion at the end of last year, a 100% gain in only a few months. Skype SARL was recently purchased by Microsoft Corp. in an 8.5 billion all-cash deal. Groupon is said to be discussing valuations of up to $25 billion, after denying Google Inc.’s offer to purchase Groupon for $6 billion in November of 2010. We’ve seen skyrocketing valuations like this before…things didn’t end well.

With the deployment of Google+ in recent days, what would Michael Porter think about these company valuations and industry profitability? Many of these internet based companies reside in industries with very few barriers to entry, high supplier power, high buyer power, several substitutes, and high competition. One wonders how valuations of businesses in these industries could rise so rapidly.Take Groupon for example:

While many of us use Groupon to save 50% or more, what does Groupon provide to a consumer that Google would not be able to provide more cost efficiently. With such low barriers to entry, and low switching costs, how challenging would it be for Google to start its own coupon program and quickly gain customers; Google Coupons perhaps? Google would be able to capitalize on synergies within the industry, relying on data processing, storage and (arguably) innovation. Moreover could a locally-focused “low cost Groupon Imitator,” or behemoth, such as Google, develop strategies which better fit their target audience, leaving Groupon straddling the line between low cost and differentiated.

This begs the question, is a company with (likely) few assets, located within such an undesirable industry worth the $25 billion valuation? Or could up-and-coming competition, able to capitalize on synergies, wreak havoc on these valuations?

Similarly Google+ may signal the end of the growth phase for Facebook, as consumers, fed up with constant privacy concerns, decide to send Facebook the way of MySpace (Someone call Justin Timberlake). Might we be witnessing the beginning of the end for two of the largest players on the internet?

Then again there are differences between this dot-com boom and the previous one. For one thing companies that go public now, and there are fewer of them, have a proven track record of generating revenues. Many of the companies that went public in the late 90’s had not generated income or revenue at the time of their IPO.

Only time will tell if the valuations of these internet based companies are accurate, or if they have progressed in to the trap of boom and bust we have seen in the past. Two things move the market, greed and fear, and after two and a half years of fearing the market, greed may be once again taking over.

No comments:

Post a Comment