People tend to respond to rewards and punishment, whether economic or physical, as a method of changing behavior. As a society, we have decided to have both positive (subsidies) and negative effects (taxation & jail) of actions to help influence the decisions that, as a society, we have decided are more beneficial.

For example, we tax cigarettes anywhere from $0.17 per pack in Missouri to $4.351 per pack in New York, with the intent of reducing use in society. In 2002 the CDC released a report that stated when Health Care costs and lost productivity costs are factored in, each pack of cigarettes smoked costs taxpayers, on average, the $7.002. This means that even New York taxes of $4.35 still passes $2.65 to the tax payer in the form of income tax and Medicaid/Medicare taxes. If taxes were raised to fully encompass the total cost of each pack of cigarettes, this influence would likely deter some individuals from smoking. Instead, the U.S. tax payer, who chooses not to smoke, subsidizes the use of cigarettes by those who do.

Thankfully for us all, cigarettes, and the total cost to the tax payer for all of the smokers in America comes to only $157 Billion, or about 4.4% of the total US Budget. What about other products that Americans use in greater quantity than cigarettes, could we be hurting ourselves by not including the full cost of other products in their price?

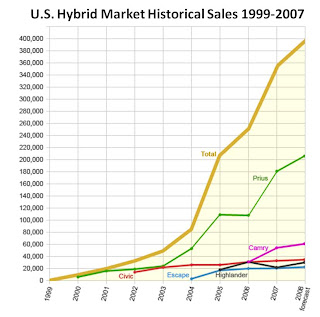

Gasoline prices have gone up in the past few years, causing outrage, spurring government action, changing the way people drive and the products that we choose to buy. Hybrid cars for example, have grown dramatically in the last few years3. We can all agree that the actual price of gas is not fully represented within the price to consumers when you factor in tax subsidies, program subsidies, protection subsidies (such as military action, funding to stabilize OPEC countries, etc), and environmental health and social costs. While some of these added costs are difficult to quantify, some are fairly simple and can be accurately accounted in to the price of a gallon of gas.

The best estimates of the tax subsidies put the total annual tax breaks that support gas production at $9.1 to $17.8 billion4. While yes, these are tax breaks, and one could argue they are not direct costs, the U.S. must still borrow and tax income at a greater rate because of these tax benefits. Program subsidies, which include cleanup and liability costs among other things cost tax payers between $38 and $114.6 billion4 each year (To be fair, 36 billion to 112 billion of this is used for roads and infrastructure and would continue to be spent even if everyone was driving an electric car).

Protection services total $55 to $96.3 billion4 per year, and social services and health costs are estimated to total $231.7 to $942.9 billion4 per year. I have also not included costs from travel delays and road congestion as these would remain, regardless of the transportation method.

So once we factor in all associated costs we can conclude that the average price of gas, if all costs are factored in, would put the price point between $5.60 and $15.144 per gallon at the pump.

Currently average gas price in the UK is around $6.52 per gallon (1.08£ per liter) and Germany is around $8.52 per gallon; one could make an argument that the UK & Germany are recognizing the full cost of gasoline in its price.

It would be very interesting to see what would happen to the social demand for development of electric cars and alternative forms of energy if a gallon of gas suddenly were to rise to $8.00 per gallon and encompass the total cost of the product in the price. Likely people would respond to the influences of taxation and develop more sustainable solutions.

Sources:

1. (Orzechowski & Walker, Tax Burden on Tobacco, 2010; media reports)

2. http://www.nytimes.com/2002/04/12/us/cigarettes-cost-us-7-per-pack-sold-study-says.html

3. http://www.hybridcars.com/files/apr08-hybrid-market-dashboard-v4.pdf